Reserve Savings

How Much is Enough?

By Matt Kuisle/ Published Sept 2015

When it comes to saving for retirement, a financial advisor told me you can never save too much. Unfortunately, community association owners don’t have the same attitude toward their reserve savings. Boards and owners alike must balance the need to keep adequate savings for future projects with the desire to keep monthly or quarterly fees at reasonable levels. Most association boards see the importance of savings but often are not sure how much to save. Should they save for plumbing that might not need any repairs for the next 20 years? Should they set up a disaster savings account to cover storm clean up or insurance deductibles? How will they explain the need to increase the monthly assessments to cover additional savings in the 2016 budget?

The Federal Housing Administration (FHA) has weighed in by requiring approved condominium projects to have at least 10 percent of the annual operating budget set aside for reserves. However, that percentage is arbitrary and usually never enough for an association that has to paint and replace roofs. Unfortunately, there is no one-size-fits-all approach to reserve savings. Adequate reserves must be calculated based on the replacement costs and useful lives of the common elements with consideration of the strategic goals of the community.

One calculation of reserve savings is determination of the “percent funded” value. By definition, “percent funded” is the ratio of the reserve fund balance to the fully-funded balance, expressed as a percentage. The fully-funded balance is the ideal balance of funds to cover the “used up” portion of a reserve component, much like accrued depreciation. If an AC unit has three years left of a total 10 year useful life, the fully funded balance is 70 percent of the total cost—meaning 70 percent of the life is “used-up”. If the association has 100 percent of the fully-funded balance on hand for that item, they are 100 percent funded at that point in time.

Theoretically, an association that is 100 percent funded should never have a special assessment or have to go to the bank for a loan. However, very few associations are 100 percent funded. The good news is that most associations never need to be 100 percent funded as all of the common elements rarely require replacement at the same time. Much like the 10 percent requirement of the FHA, the percent funded value is a fairly arbitrary number based primarily on the current reserve balance. Some have tried to show a direct relationship between percent funded and the likelihood of a special assessment, stating that an association has a strong reserve fund if it is 70 percent funded or higher. While it is certainly better to be 70 percent funded than 30 percent funded, the percentage does not provide a definitive measure of reserve fund strength or risk of a shortfall. Some associations maintain “percent funded” levels of 50 percent or 60 percent and function for decades without a special assessment while others who are 90 percent to 95 percent funded do not have enough. How can this be?

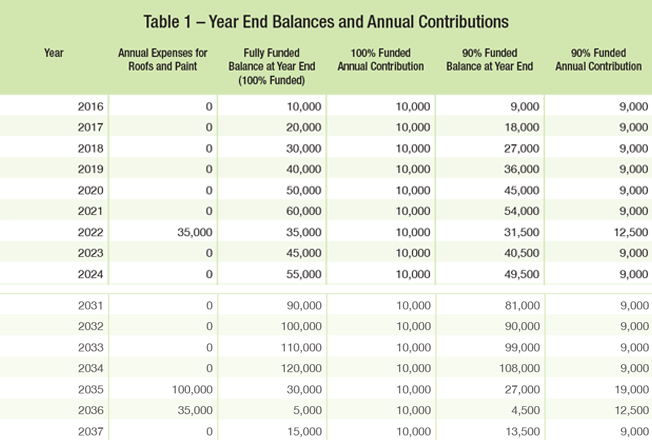

Consider this simple example: an association has a roof with a replacement cost of $100,000 and a useful life of 20 years. They also paint for $35,000 every seven years. If that association sets aside $10,000 each year ($5,000 for the roof and $5,000 for the paint), they would be considered 100 percent funded. This would eliminate the need for special assessments relating to either roofs or paint. If the board said 90 percent funding is “strong” and set out to remain 90 percent funded at the end of each year, they are going to need significantly larger reserve contributions in each year of reserve expenditures. (see Table 1)

This example shows that the relationship between percent funded and additional assessments is also a function of the number of reserve components, the ability to “borrow” from one component to another, and the cash flow of contributions and expenditures over time. Keep in mind that Florida Statutes 718 and 720 restrict the use of reserve funds to their intended purpose unless approved in advance by the members at a duly called meeting. This makes “borrowing” from another reserve item much more difficult here in Florida than it is in other parts of the country. The Florida Administrative Code also prohibits balloon payments in the funding plan so the schedule of annual contributions for the 90 percent funded level shown in Table 1 would not be an acceptable plan. While not shown in Table 1, if the association contributed a stable level of $9,000 annually, a shortfall (a.k.a., special assessment) would occur in 2035.

Instead of setting a funding goal at a target percent funded level, associations should conduct a cash flow analysis to determine how much in reserves to set aside each year. The cash flow analysis starts with a physical analysis of the property, which is the foundation for any reserve analysis. The physical analysis must include:

- An accurate and comprehensive component inventory

- Realistic useful life estimates that consider your location, initial construction methods, materials, and use and maintenance practices

- Real-world repair and replacement costs specific to the project and your location

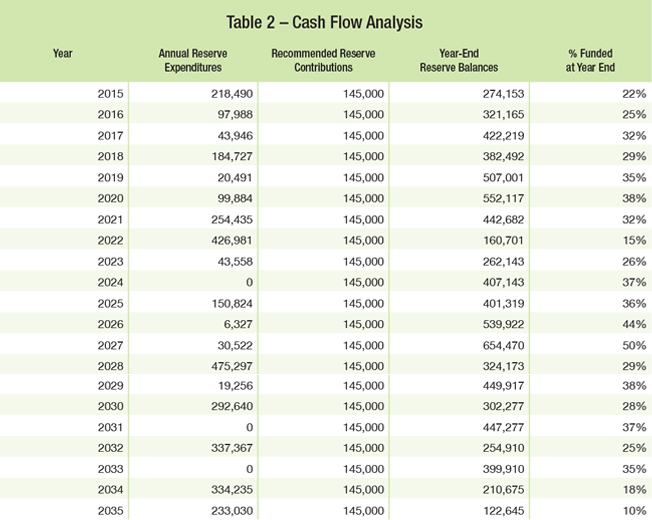

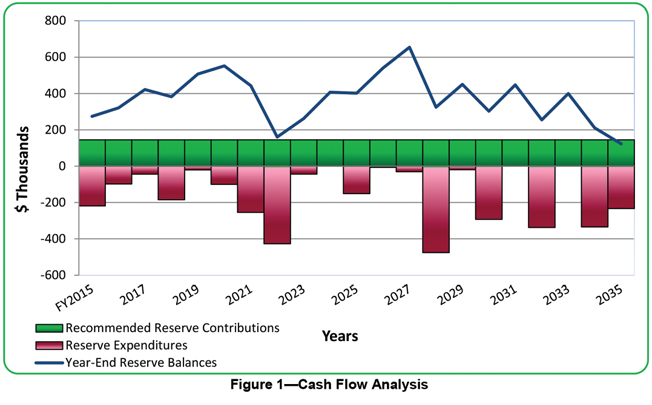

When the association determines these expense figures, they can look at the cash flow of expenses over time to determine adequate and stable contribution levels for each budget year. The cash flow of contributions should ensure that the reserve balance never drops below a reasonable threshold. Table 2 and Figure 1 below depict a typical cash flow analysis for a Florida community association.

Figure 1—Cash Flow Analysis

By Matthew C. Kuisle, P.E.. R.S., PRA

Matthew C. Kuisle is a licensed Professional Engineer, a Reserve Specialist, and a Professional Reserve Analyst serving as the Director of Florida Client Services for Reserve Advisors, Inc. Kuisle is a frequent speaker and author and can be reached in the firm’s Florida office at (800) 980-9881 or Matt@reserveadvisors.com. For more information, visit www.reserveadvisors.com.

In this example, the lowest reserve balances occur in 2022 and 2035. These are considered “critical years” in the cash flow analysis. There are still sufficient funds in the reserves during these low balance years, but the percent funded values are only 15 percent and 10 percent, respectively. The Board should consult with a professional reserve analyst to determine reasonable balance thresholds in these critical years. Florida condominium associations are only required to keep the balance in these years above zero dollars, but a prudent board will consider a higher threshold as a safety cushion against special assessments. Some boards will even consider a potential insurance deductible expense and make sure that they have funds in the reserves for emergencies even in their critical years.

While unexpected expenses like insurance deductibles make it difficult to determine exactly how much savings is enough, a prudent cash flow analysis will help guide a board through their budget planning efforts. Focusing on an arbitrary percent funded value may result in too much or too little in the bank for the predictable expenses.