Reserve Funding Strategies

By Matt Kuisle, PE, PRA, RS / Published August 2022

With the passage of new legislation (Senate Bill 4-D), condominium associations and cooperatives throughout Florida are reviewing their reserve studies and funding strategies. After December 31, 2024, the ability to waive reserve funding will be limited to “non-structural” items. There is significant debate on the exact requirements and implementation of this new bill. As of the submission of this article, it’s not entirely clear if these rules apply to all associations or just buildings that are three stories or higher. It’s also unclear if pooling of reserves would still be allowed. Additional clarifications or even modification to the statutes are likely prior to the deadline. However, the legislation appears to remove the ability of the owners to completely waive reserve funding. The ability to waive was unique to Florida and has resulted in thousands of communities in our state with inadequate funding to cover the costs of aging infrastructure and amenities. Without proper funding, communities often face special assessments or worse, deferral of essential repair or replacement projects.

Boards and managers who want to ensure adequate funds and avoid shortfalls (or at least get into a better financial position) should familiarize themselves with common reserve funding goals and the strategies to achieve them. As outlined in the National Reserve Study Standards (NRSS), there are four accepted funding goals available to community associations. Each goal involves a strategy to identify the reserve contribution rate for residents each year while maintaining a predetermined reserve fund balance. Each of the four funding strategies are generally determined by analyzing the risk tolerance and best interests of the community. When you engage a professional reserve study provider, they will suggest one of the strategies that is most applicable for your specific community. Let’s briefly review each funding goal.

The first funding goal is full funding. This is a goal of attaining and maintaining a 100 percent funded reserve balance. In order to have a 100 percent funded balance, an association would need to have the equivalent of the sum of the fully funded balances for each individual component in their schedule. The fully funded balance for a component is the replacement cost relative to the portion of life that is “used up.” For example, if an item has a $100,000 cost and is halfway through its useful life, the fully funded balance would be $50,000. The fully funded balance for each item is added together to determine the fully funded balance of the overall fund.

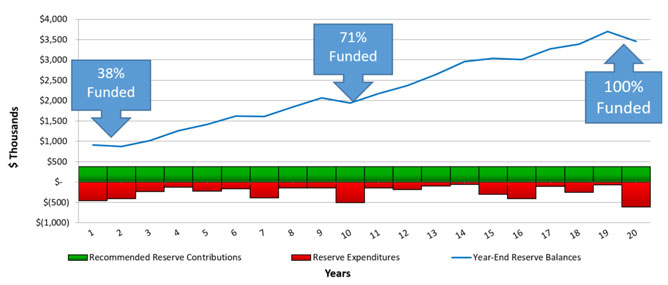

Full funding is the most conservative funding goal. In practice, there is typically no justification for why an association would need to have 100 percent of the fully funded balance on hand at any given time. For most communities, where projects are dispersed over many years, this goal results in mass amounts of money being held aside unnecessarily. However, in communities where all component repairs and replacements come due at the same time, this strategy may be unavoidable, though this situation is extremely rare. Figure one on page 30 outlines a typical association (130 units, 28 years old) that is currently 38 percent funded. The chart shows their cash flow needs (strategy) to become 100 percent funded within 20 years. This particular strategy resulted in an initial $119/month increase in funding per owner with stable funding thereafter to achieve this goal. Overall, this strategy would result in owners contributing $7.5M to reserves over the next 20 years to fund $5M of projects over the same period of time.

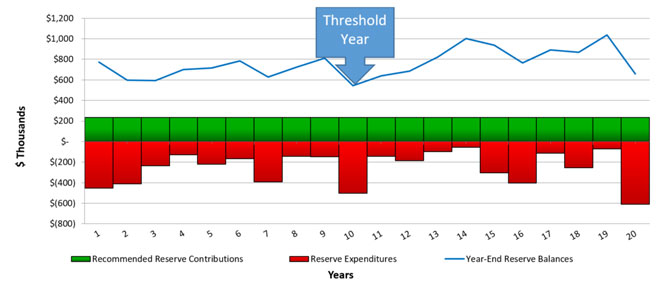

The second funding goal is threshold funding, which is the strategy most commonly recommended by reserve professionals. A threshold funding goal is to keep the reserve balance above a minimum amount at all times. Setting this goal requires looking at the cash inflows and outflows to the reserves over time. Since most communities never replace everything at one time, the balance is allowed to increase and decrease as time passes. The inflows can be set at an adequate and

stable level that ensures the reserve balance never drops below the threshold, even in critical funding years when the balance is at its lowest. This goal is ideal for most communities as it involves stable funding, equitable contributions across time, and adequate funds for major repairs and replacements, which happen throughout the life of a community but usually not all at once. Figure two on page 32 outlines the same association as above, just with a different goal of maintaining a threshold of at least $500,000 throughout the cash flow analysis. This strategy resulted in an initial increase of only $29/month per owner for the same association.

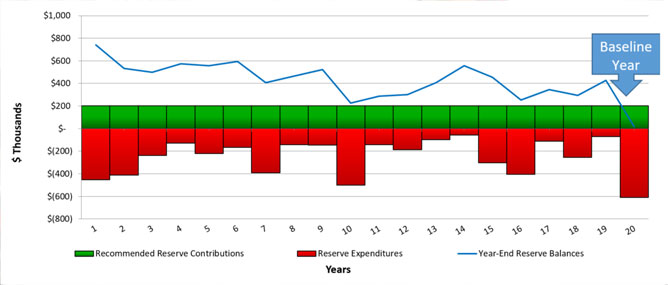

Next up is baseline funding. This goal operates similarly to threshold funding; however, the reserve fund hits a $0 balance at some point over the length of the reserve study (see Figure three). This is a riskier strategy than either full funding or threshold funding. It is generally only recommended in situations of distress as there is no cushion whatsoever on the cash flow. Currently in Florida, it is the minimum allowable funding level without a necessary vote from the unit owners to waive reserves. If any capital project comes early or costs more than expected, this strategy could put the association in a funding deficit. This strategy is not ideal but is better than deferring critical safety issues or other expenses that would result in higher costs if ignored, such as roofing. Sticking with the same example the association would be able to achieve this goal with a minimal increase of only $8/month per owner.

Last is statutory funding. Because statutory funding refers to the amount of money required in reserve funds to comply with state statutes, this funding goal varies by state. For example, Michigan requires associations to maintain a reserve fund of 10 percent of the annual budget at a minimum, which occurs on a noncumulative basis. In Florida, any of the three goals listed above (full, threshold, or baseline) are allowed. The new Florida legislation does not modify the ability for associations to use any of the three prior goals, though it may require a separate analysis of “structural” vs “non-structural” reserve components.

With the recently introduced reserve requirements and more possible changes on the horizon, reserve funding strategies and requirements are going to be at the center of discussion in our communities this budget season. For communities that have not historically set and achieved funding goals for reserves, the new requirements are likely to result in significant increases in assessment levels. However, be assured that there are usually options available and professionals—including association bankers, accountants, professional reserve study providers, and attorneys—who can provide advice and expert guidance to help your community thrive and stay on course towards a successful future.

Matthew C. Kuisle, PE, PRA, RS

Regional Director and Shareholder, Reserve Advisors

Matthew C. Kuisle, PE, PRA, RS, is a regional director and shareholder of Reserve Advisors. Mr. Kuisle is responsible for the overall management and administration of the firm’s Southeast region through its Tampa, Florida, office. As the largest reserve study provider in Florida, Mr. Kuisle and his team of consultants provide the most comprehensive engineering analyses and industry-leading budgeting reports that guide common interest realty associations in fulfilling their fiduciary responsibilities for the maintenance, operation, and longevity of their properties. For more information on Reserve Advisors, call (800) 980-9881 or visit www.reserveadvisors.com.