“The Best Offense Is a Good Defense”

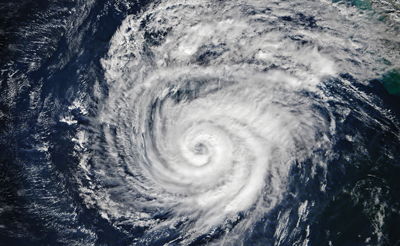

Storms Are Coming! Are You Covered and Will You Cooperate?

By Richard Hunter / Published June 2022

S

torm Preparedness

Storm season in Florida is approaching! Has your association board reviewed its policy to ensure the proper coverage is in place or an appropriate deductible is in place? Have you conducted a pre-disaster evaluation to document the condition of your buildings? If not, the board is at potential risk as a fiduciary if a storm hits and proper coverage has not been placed or a proper review of coverage has not been conducted.

Policy Analysis

A policy—which may run hundreds of pages—contains many components, including a declarations page (dec page). The dec page is normally the first page of the policy that contains specific policy information and outlines the contents of the entire policy and all of its endorsements and or limitations. For instance, the dec page will include the name of the insurance company, policy number, different types of coverages included in the policy, coverage limits, and coverage costs. The dec page also outlines the policy forms, endorsements, exclusions, limitations, additional or supplemental coverage(s), deductibles, and sub-limits.

The endorsements that the insurance company has made part of the policy change the main form and add, subtract, or limit coverage from the main policy. The endorsement section may include such issues as hurricane deductibles, water limitations, preferred contractor requirements, or specific exclusions for perils such as wind and hail.

Additionally, the dec page also includes the name and mailing address of the policyholder/named insured; the physical address of the insured property, if different than the mailing address; and the name, mailing address, and contact information of the insurance agent who issued the policy.

It is very important for the named insured to be accurately identified on the dec page because if the named insured is incorrectly identified, such a misnomer could cause an insurance company to challenge whether the policy is valid as to the policyholder. Further, if there are any additional insureds that should be named in the policy, the dec page should also list them. Finally, the dec page will generally include a schedule of locations/buildings that is covered by the policy. Again, to the extent this information is not properly listed on the dec page, the association may run into problems if this information is not accurately portrayed should an insured event occur.

Hurricane Deductibles

Florida has what is called a single season or calendar year hurricane deductible. This hurricane deductible provision, which may be a varied dollar or percentage deductible, is found on the dec page and will apply to all covered windstorm claims that arise during a hurricane. The hurricane deductible applies on a calendar year basis as long as you are insured by the same group of insurance companies for all subsequent hurricanes. As a consequence, you only have to pay one hurricane deductible within a given calendar year provided you are insured with the same insurance group when a second hurricane causes damage during the same calendar year. Once the entire hurricane deductible for the calendar year is met in full, the policy reverts to the “all peril” deductible stated on the dec page to other hurricane claims that occur during the same year.

Pre-Disaster Evaluations of Property

Pre-Disaster Evaluations of Property

Public adjusters offer HOA and condominium associations pre-disaster evaluations of their properties and policies in order to document the condition of the property prior to any potential claim. As a general practice, these kinds of evaluations should be performed in the months prior to hurricane season. A pre-disaster evaluation produces documentation to provide to the carrier in the event of a claim. Such documentation prevents the insurance company from claiming that the damage was preexisting and therefore not covered. Public adjusters often work with supporting professionals—such as insurance agents/brokers, property maintenance teams, property managers, general contractors, and engineers—to ensure that all bases are covered both before disaster strikes and throughout the process in the event of a loss.

In the Event of a Claim

Duties after a loss

Property insurance policies include a section called duties after loss. This section outlines the contractual requirements of the association following a loss. A typical example of a duties-after-loss section appears as follows:

Duties in the Event of Loss or Damage

- You must see that the following are done in the event of loss or damage to covered property:

- Notify the police if a law may have been broken.

- Give us prompt notice of the loss or damage. Include a description of the property involved.

- As soon as possible, give us a description of how, when, and where the loss or damage occurred.

- Take all reasonable steps to protect the covered property from further damage by a covered cause of loss. If feasible, set the damaged property aside and in the best possible order for examination. Also keep a record of your expenses for emergency and temporary repairs for consideration in the settlement of the claim. This will not increase the limit of insurance.

- At our request, give us complete inventories of the damaged and undamaged property. Include quantities, costs, values, and amount of loss claimed.

- As often as may be reasonably required, permit us to inspect the property proving the loss or damage and to examine your books and records. Also permit us to take samples of damaged and undamaged property for inspection, testing, and analysis, and permit us to make copies from your books and records.

- Send us a signed, sworn proof of loss containing the information we request to investigate the claim. You must do this within 60 days after our request. We will supply you with the necessary forms.

- Cooperate with us in the investigation or settlement of the claim.

- We may examine any insured under oath, while not in the presence of any other insured and at such times as may be reasonably required, about any matter relating to this insurance or the claim, including an insured’s books and records. In the event of an examination, an insured’s answers must be signed.

A professional, licensed public adjusting company is experienced in presenting claims to insurance companies and from this experience has significant experience in evaluating coverage and determining shortfalls in coverage from prior claim denials or underpayments.

Making a Claim

In the event of hurricane damage to association property, the association must comply in a timely manner with its duties after loss and cooperate with the insurance company in its investigation of the claim. To the extent the association does not comply with all of the many insurance company requests, the insurance company may try to deny the claim for a failure to comply with the association’s obligatory duties after loss.

Additionally, new Florida Statute §627.70132(2) requires that notice of a “claim” or “reopened claim” for any property loss be given in accordance with the terms of the policy within two years after the date of loss, or it’s barred.

With respect to a “supplemental claim”—a claim for additional loss or damage from the same peril which the insurer previously adjusted or for which costs have been incurred while completing repairs or replacement pursuant to an open claim for which a timely notice was previously provided—notice must be given in accordance with the terms of the policy within three years after the date of loss, or it’s barred.

With respect to a “supplemental claim”—a claim for additional loss or damage from the same peril which the insurer previously adjusted or for which costs have been incurred while completing repairs or replacement pursuant to an open claim for which a timely notice was previously provided—notice must be given in accordance with the terms of the policy within three years after the date of loss, or it’s barred.

Amended Florida Statute §627.70132 expanded the statute from only hurricane claims to apply to all property insurance claims. As such, associations must be diligent in providing a timely notice of any and all potential claims to their insurance companies or risk losing the claim entirely.

Public adjusters specialize in assisting associations and insureds in complying with all policy requirements and duties after loss. They will evaluate the damage; assist in providing prompt notice to the insurance company and describe how, when, and where the damage occurred; assist in taking all reasonable steps to prevent further damage; provide inventories; record expenses; and assist in preparing a proof-of-loss statement. Further, in the event a proof of loss is requested, an experienced public adjuster will bring the appropriate experts and estimators to the table to submit a signed, sworn proof of loss containing the information the insurance company requests to investigate the claim.

This is the bottom line—the name of the game in duties after loss is cooperation. Every reasonable request must receive a reasonable response and reasonable effort to provide the insurance company the information it needs to make a coverage determination. An experienced public adjuster will help you in this process every step of the way.

Richard Hunter

Principal Adjuster, Hunter Claims

Richard Hunter is a principal adjuster with Hunter Claims. If you or the board of your association would like a professional analysis of your coverage or a pre-storm evaluation of your property, call (813) 774-7634 or send an email to richard@hunterclaims.com today.